The recording is available on CustomsClear for purchase. Contact us at info@customsclear.net if you want to be notified about it.

The Carbon Border Adjustment Mechanism (CBAM) is a climate measure that aims to prevent the risk of carbon leakage and support the EU’s increased climate mitigation ambitions. It will enter into operation on 1st October 2023. It will initially apply to imports of certain goods and selected precursors whose production is carbon intensive and at most significant risk of carbon leakage: cement, iron and steel, aluminium, fertilisers, electricity and hydrogen. It affects EU and non-EU companies in these industries, as well as exporting and importing companies and EU customs representatives alike.

The training is designed for import and export professionals, customs managers, R&D Managers, Engineers, PM Product Managers, Supply Chain & Logistics / Operations Responsible Persons, General Managers, Managing Directors (for overview and understanding) – everyone involved in moving carbon-intensive products around the globe with touchpoints in the European Union.

This three-hour course is designed to help you deal with all activities required to help you prepare and implement the CBAM – EU Carbon Border Adjustment Mechanism – private or public organisations. We will teach you how the new EU law works, the timeline, how to calculate the carbon price and how to apply for CBAM certificates as well as how to set up CBAM-compliant processes and procedures.

Topics

In this hands-on training, the following will be carried out:

- The concept of CBAM – What is it, why is it and how does it work?

- Overview of key features and review of the law

- Affected products

- Process and requirements in terms of data, process steps, etc.

- Requirements and processes to follow in various European countries

- How to calculate the carbon emissions of affected products

- CBAM certificates – how to purchase them

- ETS – what is it and how does it work – how does CBAM play a role

The training includes

- The possibility to send us (info@customsclear.net) your questions prior to the training – they will be addressed during the training

- Q&A session at the end of the training

- Slides will be provided to you after the training

- Participants are invited to complete a Quiz after the training. If they pass with a rate of 80%, they will receive a Certificate of Completion in “CBAM – The EU Carbon Border Adjustment Mechanism – Implementation In Companies” – Level 1 – Awareness. This ascertains that you have received formal training.

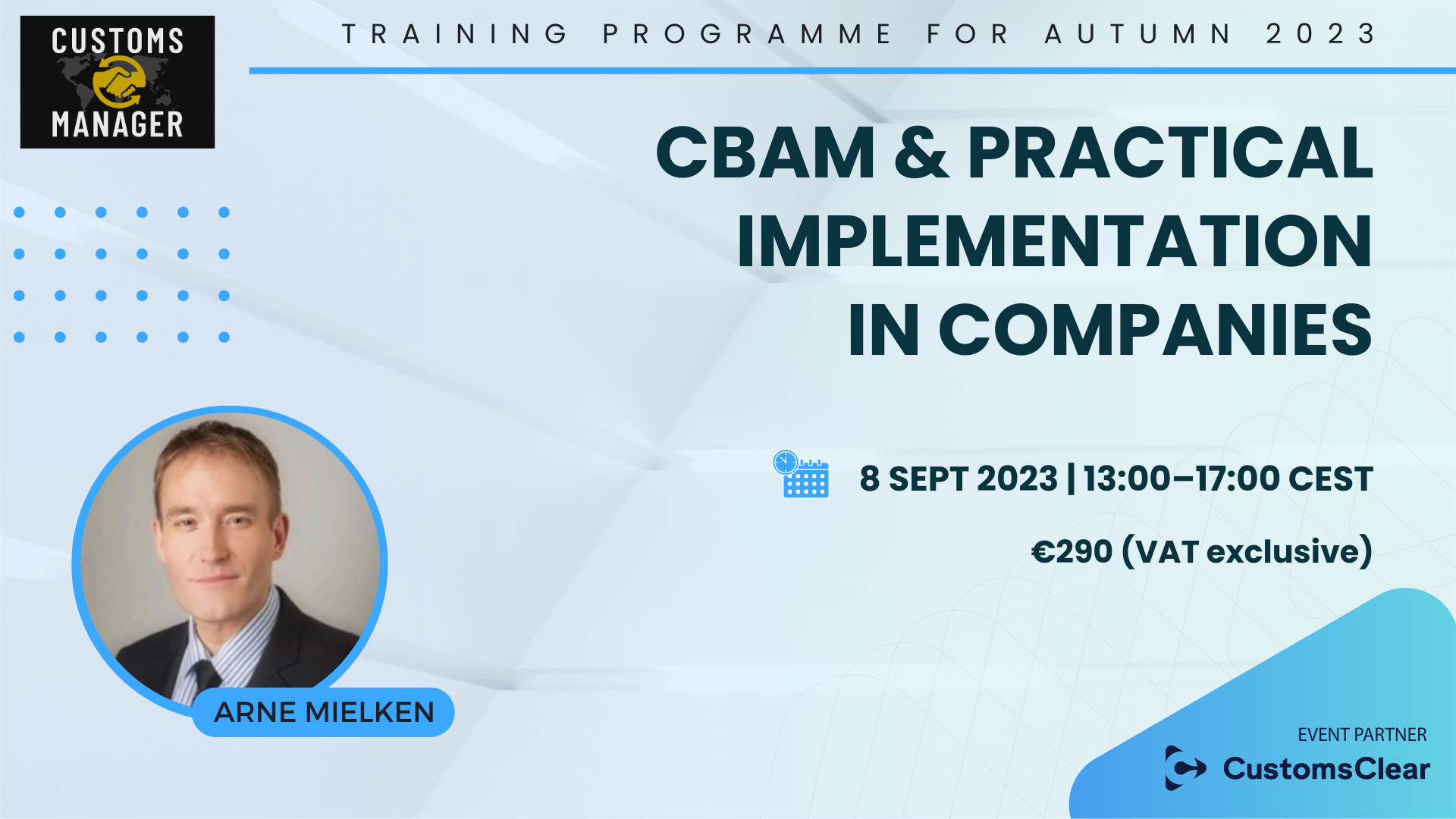

Lecturer

Arne Mielken is a leading global trade professional in the UK and the EU and Managing Director of Customs Manager Ltd. He is accredited customs & export control practitioner and certified classification specialist. Arne is on a mission to empower businesses and people with import and export responsibilities with advice, consulting, training and trade intelligence to grow their businesses by trading across the border effectively, efficiently and, of course, compliantly. He holds a BA (Hons) on International Business and Modern Languages and an Executive MBA. He holds a Diploma in World Customs Compliance and Procedures. He is a member of the EU’s Trade Contact Group (TCG) od DG TAXUD and a member of the HMRC-sponsored Joint Customs Consultative Committee (JCCC). He often speaks at public events and writes on customs and global trade topics. He speaks German, English, French and Spanish.